Research

Working papers

Standing in Prisoners’ Shoes: A Randomized Trial on How Incarceration Shapes Criminal Justice Preferences

CESifo Working Paper No. 12455 (with Arto Arman, Andreas Beerli and Aljosha Henkel)

We study how incarceration experience shapes preferences for criminal justice policies. In collaboration with a newly opened prison, we conducted a randomized field experiment that offered citizens the opportunity to experience up to two days of incarceration, closely replicating the real-life journey of inmates. Providing citizens with a chance to gain firsthand incarceration leads to a significant shift in punitive attitudes, with participants becoming less supportive of harsh criminal justice policies and donating more money to organizations advocating more moderate justice policies. Although individuals overestimated the wellbeing of actual prisoners, the intervention did not alter these beliefs. This suggests that the observed changes in policy preferences are driven more by personal experience than by revised beliefs about the burden of confinement. By randomizing institutional exposure outside the laboratory, our study highlights the causal role of personal experience in the formation of policy preferences.

Publications

What Do Cross-country Surveys Tell Us About Social Capital?

Review of Economics and Statistics 2025, vol. 107, pp. 142–151 (with David Tannenbaum, Alain Cohn, and Christian Zünd)

We assess the predictive power of survey measures of social capital with a new behavioral data set that examines whether citizens report a lost wallet to its owner. Using data from more than 17,000 “lost” wallets across 40 countries, we find that survey measures of social capital—especially questions concerning generalized trust or generalized morality — are strongly and significantly correlated with country-level differences in wallet reporting rates. A second finding is that lost wallet reporting rates predict unique variation in the outputs of social capital, such as economic development and government effectiveness, not captured by existing measures.

Working Paper. Link to published version.

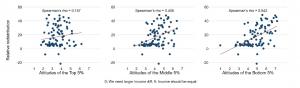

Whose Preferences Matter for Redistribution: Cross-Country Evidence

Journal of Political Economy: Microeconomics 2025, vol. 3 pp. 1-24 (with Alain Cohn, Jeffrey Yusof, and Raymond Fisman)

Using cross-sectional data from 93 countries, we investigate the relationship between the desired level of redistribution among citizens from different socioeconomic backgrounds and the actual extent of government redistribution. Our focus on redistribution arises from the inherent class conflicts it engenders in policy choices, allowing us to examine whose preferences are reflected in policy formulation. Contrary to prevailing assumptions regarding political influence, we find that the preferences of the lower socioeconomic group, rather than those of the median or upper strata, are most predictive of realized redistribution. This finding contradicts the expectations of both leading experts and regular citizens.

Link to published version

Honesty in the Digital Age

Management Science 2022, vol. 68, pp. 827-845 (with Alain Cohn, and Tobias Gesche)

Modern communication technologies enable efficient exchange of information, but often sacrifice direct human interaction inherent in more traditional forms of communication. This raises the question of whether the lack of personal interaction induces individuals to exploit informational asymmetries. We conducted two experiments with 866 subjects to examine how human versus machine interaction influences cheating for financial gain. We find that individuals cheat significantly more when they interact with a machine rather than a person, regardless of whether the machine is equipped with human features. When interacting with a human, individuals are particularly reluctant to report unlikely favorable outcomes, which is consistent with social image concerns. The second experiment shows that dishonest individuals prefer to interact with a machine when facing an opportunity to cheat. Our results suggest that human interaction is key to mitigating dishonest behavior and that self-selection into communication channels can be used to screen for dishonest people.

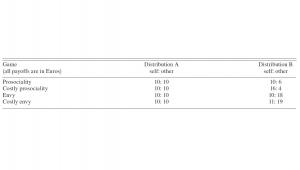

Motivated misremembering of selfish decisions

Nature Communications, 2020, 11: 2100 (with Ryan Carlson, Bastiaan Oud, Ernst Fehr and Molly Crockett)

People often prioritize their own interests, but also like to see themselves as moral. How do individuals resolve this tension? One way to both pursue personal gain and preserve a moral self-image is to misremember the extent of one’s selfishness. Here, we test this possibility. Across five experiments (N=3190), we find that people tend to recall being more generous in the past than they actually were, even when they are incentivized to recall their decisions accurately. Crucially, this motivated misremembering effect occurs chiefly for individuals whose choices violate their own fairness standards, irrespective of how high or low those standards are. Moreover, this effect disappears under conditions where people no longer perceive themselves as responsible for their fairness violations. Together, these findings suggest that when people’s actions fall short of their personal standards, they may misremember the extent of their selfishness, thereby potentially warding off threats to their moral self-image.

Download pre-print and Supplementary Materials

Link to published version

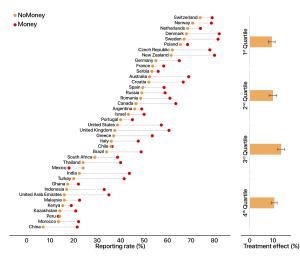

Civic Honesty Around the Globe

Science, 2019 vol. 365, issue 6448, pp. 70-73 (with Alain Cohn, David Tannenbaum and Christian Zünd)

Civic honesty is essential to social capital and economic development but is often in conflict with material self-interest. We examine the trade-off between honesty and self-interest using field experiments in 355 cities spanning 40 countries around the globe. In these experiments, we turned in more than 17,000 lost wallets containing varying amounts of money at public and private institutions and measured whether recipients contacted the owners to return the wallets. In virtually all countries, citizens were more likely to return wallets that contained more money. Neither nonexperts nor professional economists were able to predict this result. Additional data suggest that our main findings can be explained by a combination of altruistic concerns and an aversion to viewing oneself as a thief, both of which increase with the material benefits of dishonesty.

Download paper and Supplementary Materials

Commentary by Shaul Shalvi. Featured in Economist, Guardian, New York Times, Scientific American, NZZ, SRF 10vor10

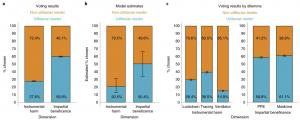

Moral Dilemmas and Trust in Leaders During a Global Health Crisis

Registered Report at Nature Human Behaviour (with Jim Everett, Clara Colombatto, Molly Crockett, et al.)

Trust in leaders is central to citizen compliance with public policies. One potential determinant of trust is how leaders resolve conflicts between utilitarian and non-utilitarian ethical principles in moral dilemmas. Past research suggests that utilitarian responses to dilemmas can both erode and enhance trust in leaders: sacrificing some people to save many others (‘instrumental harm’) reduces trust, while maximizing the welfare of everyone equally (‘impartial beneficence’) may increase trust. In a multi-site experiment spanning 22 countries on six continents, participants (N = 23,929) completed self-report (N = 17,591) and behavioural (N = 12,638) measures of trust in leaders who endorsed utilitarian or non-utilitarian principles in dilemmas concerning the COVID-19 pandemic. Across both the self-report and behavioural measures, endorsement of instrumental harm decreased trust, while endorsement of impartial beneficence increased trust. These results show how support for different ethical principles can impact trust in leaders, and inform effective public communication during times of global crisis.

Frequent job changes can signal poor work attitude and reduce employability

forthcoming in Journal or the European Economic Association (with Alain Cohn, Frédéric Schneider and Roberto Weber)

We use laboratory and field experiments and a survey experiment with Human Resources professionals to investigate whether frequent job changes provide a signal of poor non-cognitive skills and whether firms therefore use employment histories to discriminate against employees who switch jobs frequently. Across all three studies, we find consistent evidence that workers who change jobs less frequently have, or are perceived to have, better non-cognitive skills, and are thus more employable.These findings highlight the importance of job history as a signal of non-cognitive skills in labor markets, and point to a cost of frequent job changes for workers.

Download Paper. Featured in Capital Ideas.

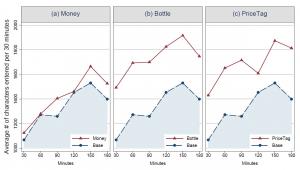

The Currency of Reciprocity - Gift-exchange in the Workplace

American Economic Review, 2012, vol. 102, pp. 1644–1662 (with Sebastian Kube and Clemens Puppe)

What determines reciprocity in employment relations? We conducted a controlled field experiment to measure the extent to which monetary and non-monetary gifts affect workers’ performance. We find that non-monetary gifts have a much stronger impact than monetary gifts of equivalent value. We also observe that when workers are offered the choice, they prefer receiving money but reciprocate as if they received a non-monetary gift. This result is consistent with the common saying, “it’s the thought that counts”. We underline this point by showing that also monetary gifts can effectively trigger reciprocity if the employer invests more time and effort into the gift’s presentation.

Download Paper. Link to published version. Online Appendix

Featured in Harvard Business Review / Slate, Wall Street Journal, NZZ

Evidence for Countercyclical Risk Aversion: An Experiment with Financial Professionals

American Economic Review (with Alain Cohn, Jan Engelmann and Ernst Fehr), 2015, vol. 105, pp. 860-885.

Countercyclical risk aversion can explain major puzzles such as the high volatility of asset prices but evidence for its existence is scarce because of the host of factors that simultaneously change during financial cycles. We circumvent these problems by priming financial professionals with either a boom or a bust scenario. Subjects primed with a financial bust were substantially more fearful and risk averse than those primed with a boom, suggesting that fear may play an important role in countercyclical risk aversion. The mechanism described here is relevant for theory and may explain self-reinforcing processes that amplify market dynamics.

Download Paper. Link to published version. Online Appendix

Featured in NZZ

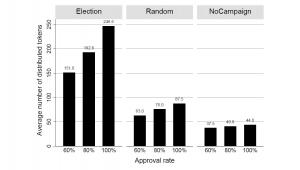

Elections and Deceptions: An Experimental Study on the Behavioral Effects of Democracy

American Journal of Political Science, 2014, vol. 58, pp. 579-592 (with Luca Corazzini, Sebastian Kube and Antonio Nicoló)

Traditionally, the virtue of democratic elections has been seen in their role as means of screening and sanctioning shirking public officials. This paper proposes a novel rationale for elections and political campaigns considering that candidates incur psychological costs of lying, in particular from breaking campaign promises. These non-pecuniary costs imply that campaigns influence subsequent behavior, even in the absence of reputational or image concerns. Our lab experiments reveal that promises are more than cheap talk. They influence the behavior of both voters and their representatives. We observe that the electorate is better off when their leaders are elected democratically rather than being appointed exogenously - but only in the presence of electoral campaigns. In addition, we find that representatives are more likely to serve the public interest when their approval rates are high. Altogether, our results suggest that elections and campaigns confer important benefits beyond their screening and sanctioning functions.

Download Paper. Link to published version. Supporting Information.

Summary of the Study

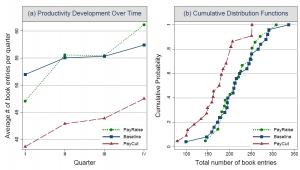

Do Wage Cuts Damage Work Morale? Evidence from a Natural Field Experiment

Journal of the European Economic Association, 2013, vol. 11, pp. 853-870 (with Sebastian Kube and Clemens Puppe)

Employment contracts are often incomplete, leaving many responsibilities subject to workers’ discretion. High work morale is therefore essential for sustaining voluntary cooperation and high productivity in firms. We conducted a field experiment to test whether workers reciprocate wage cuts and raises with low or high work productivity. Wage cuts had a detrimental and persistent impact on productivity, reducing average output by more than 20 percent. An equivalent wage increase, however, did not result in any productivity gains. The results from an additional control experiment with high monetary performance incentives demonstrate that workers could still produce substantially more output, leaving enough room for positive reactions. Altogether, these results provide evidence consistent with a model of reciprocity, as opposed to inequality aversion.

Bad Boys: How Criminal Identity Salience Affects Rule Violation

Review of Economic Studies, 2015, vol. 82, pp. 1289-1308 (with Alain Cohn and Thomas Noll)

We conducted an experiment with 182 inmates from a maximum security prison to analyze the impact of criminal identity salience on cheating. The results show that inmates cheat more when we exogenously render their criminal identity more salient. This effect is specific to individuals who have a criminal identity, because an additional placebo experiment shows that regular citizens do not become more dishonest in response to crime-related reminders. Moreover, our experimental measure of cheating correlates with inmates' offenses against in-prison regulation. Together, these findings suggest that criminal identity salience plays a crucial role in rule violating behavior.

Download Paper. Link to published version. Online Appendix

Featured in Freakonomics Blog

Hidden Persuaders: Do Small Gifts Lubricate Business Negotiations?

Management Science, 2019 vol. 65, pp. 3877-3888 (with Christian Thöni)

Gift-giving customs are ubiquitous in social, political, and business life. Legal regulation and industry guidelines for gifts are often based on the assumption that large gifts potentially influence behavior and create conflicts of interest, but small gifts do not. However, scientific evidence on the impact of small gifts on business relationships is scarce. We conducted a natural field experiment in collaboration with sales agents of a multinational consumer products company to study the influence of small gifts on the outcome of business negotiations. We find that small gifts matter. On average, sales representatives generate more than twice as much revenue when they distribute a small gift at the onset of their negotiations. However, we also find that small gifts tend to be counterproductive when purchasing and sales agents meet for the first time, suggesting that the nature of the business relationship crucially affects the profitability of gifts.

Working Paper. Link to published version.

Business Culture and Dishonesty in the Banking Industry

Nature, 2014, vol. 516, pp 86–89 (with Alain Cohn and Ernst Fehr)

Trust in others’ honesty is a key component of the long-term performance of firms, industries, and even whole countries. However, in recent years, numerous scandals involving fraud have undermined confidence in the financial industry. Contemporary commentators have attributed these scandals to the financial sector’s business culture, but no scientific evidence supports this claim. Here we show that employees of a large, international bank behave, on average, honestly in a control condition. However, when their professional identity as bank employees is rendered salient, a significant proportion of them become dishonest. This effect is specific to bank employees because control experiments with employees from other industries and with students show that they do not become more dishonest when their professional identity or bank-related items are rendered salient. Our results thus suggest that the prevailing business culture in the banking industry weakens and undermines the honesty norm, implying that measures to re-establish an honest culture are very important.

Download Paper and Supplementary Information

Summary of the Study (English / Deutsch)

Laboratory Measure of Cheating Predicts School Misconduct

accepted for publication in Economic Journal (with Alain Cohn)

We conducted an experiment with middle and high school students to test the external validity of a common laboratory measure of cheating. Subjects performed several coin tosses and earned money depending on the outcomes they reported. Because the coin tosses were not monitored, subjects faced a financial incentive to misreport their outcomes without having to worry about getting caught. We linked the responses from the lab experiment with three measures of school misconduct (i.e., disruptiveness in class, failure to complete homework, and absenteeism). The findings show that cheating in the lab signicantly predicts misbehavior in school, suggesting that the experimental measure of cheating generalizes qualitatively to naturally occurring environments.

Download Paper. Link to published version

Increasing Honesty in Humans with Noninvasive Brain Stimulation

Proceedings of the National Academy of Sciences (PNAS), vol. 114, pp. 4360-4364 (with Alain Cohn, Christian Ruff and Giuseppe Ugazio)

Honesty plays a key role in social and economic interactions and is crucial for societal functioning. However, breaches of honesty are pervasive and cause significant societal and economic problems that can affect entire nations. Despite its importance, remarkably little is known about the neurobiological mechanisms supporting honest behavior. We demonstrate that honesty can be increased in humans with transcranial direct current stimulation (tDCS) over the right dorsolateral prefrontal cortex. Participants (n = 145) completed a die-rolling task where they could misreport their outcomes to increase their earnings, thereby pitting honest behavior against personal financial gain. Cheating was substantial in a control condition but decreased dramatically when neural excitability was enhanced with tDCS. This increase in honesty could not be explained by changes in material self-interest or moral beliefs and was dissociated from participants’ impulsivity, willingness to take risks, and mood. A follow-up experiment (n = 156) showed that tDCS only reduced cheating when dishonest behavior benefited the participants themselves rather than another person, suggesting that the stimulated neural process specifically resolves conflicts between honesty and material self-interest. Our results demonstrate that honesty can be strengthened by noninvasive interventions and concur with theories proposing that the human brain has evolved mechanisms dedicated to control complex social behaviors.

Do Professional Norms in the Banking Industry Favor Risk-Taking

accepted for publication in Review of Financial Studies (with Alain Cohn and Ernst Fehr)

In recent years, the banking industry has witnessed several cases of excessive risk-taking that have frequently been attributed to problematic professional norms. We conducted experiments with employees from several banks where we manipulated the saliency of their professional identity and subsequently measured their risk aversion in a real-stake investment task. If bank employees are exposed to professional norms that favor risk-taking, they should become more willing to take risks when their professional identity is salient. We find, however, that subjects take significantly less risk, challenging the view that the professional norms generally increase bank employees' willingness to take risks.

Featured in Harvard Law School Forum

Egalitarianism and Competitiveness

American Economic Review, Papers & Proceedings, 2009, vol. 99, pp. 93-98 (with Björn Bartling, Ernst Fehr and Daniel Schunk)

No abstract available

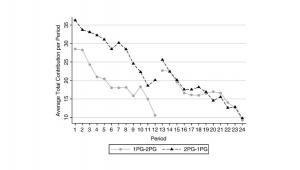

Two are better than One! Individuals’ Contributions to 'Unpacked' Public Goods

Economics Letters, 2009, vol. 104, pp. 31-33 (with Michele Bernasconi, Luca Corazzini and Sebastian Kube)

We experimentally demonstrate how “unpacking” provides a possible approach for mitigating the dilemma

of public goods provision through private contributions. Subjects' total contributions increase when a single

public good is split into two identical public goods.